Top Options Trading Strategies for Weekly Income – Used by Pro Traders

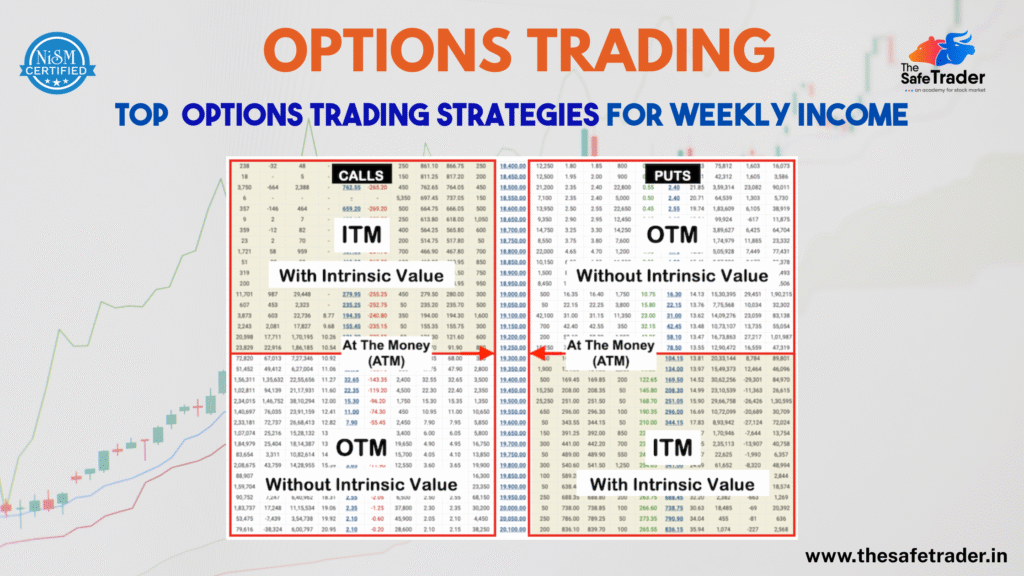

Introduction Have you ever put a trade in options with great expectations and witnessed it going against you? You are not alone. Thousands of retail traders in India jump into Nifty and BankNifty options every week hoping to make fast money. But the truth is, only a small percentage of them use proper strategies. The rest depend on luck or random tips—and often end up in losses. In this blog, we unveil the Top 7 Options Trading Strategies that will help you: What is Options Trading? Before diving into the strategies, let’s quickly understand what Options Trading is. An option is a financial instrument that gives you the right, but not the obligation, to purchase or sell an underlying asset (such as Nifty, BankNifty, or stocks) at a specified price on or before a particular date. There are two types of options: By using options, you can: ✅ Speculate on price movements ✅ Hedge your existing positions ✅ Generate income in range-bound markets Top 7 Options Trading Strategies for Weekly Income 1. The Iron Condor Strategy | Income from Sideways Markets What It Is: Non-directional strategy wherein you receive money when the price remains in a certain range. How It Works: The profit consists of premiums collected so long as the price remains in the range between the two options sold. Ideal For: Those traders who have low-volatility expectations (sideways) such as a mid-week session or consolidation. Why Should a Beginner Give This a Shot: Risk is limited; setup is easy to understand and executes well during calme hours-this will boost your confidence. 💡 Pro Tip: Employ this in expiration weeks when markets tend to settle and stay flat after the big move. 2. Bull Call Spread – Low-Cost Strategy in a Rising Market What It Is: Strikes a balance between making money from moderate upward movement in the market and not spending too much on premiums. How It Works: The money you receive from selling the OTM call reduces the cost of buying the ITM call. Ideal For: A slowly bullish market— not too strong but continuously upward. Why Should a Beginner Try This: Because it limits profits, as well as loss, it presents a controlled risk in learning how calls behave. 3. Bear Put Spread – Profit from Falling Markets What It Is: A bearish approach allowing you to make money when you expect the market to fall down gradually. How It Works: Much similar to the Bull Call Spread, this strategy reduces cost and limits risk. So you are betting that the price will go down-but not drastically down. Ideal For: Use when you expect a gradual downtrend in Nifty or Bank Nifty. Why Should a Beginner Try This: It’s safer than buying a naked put and gives you a taste of bearish trading with limited risk. 4. Short Straddle – Expiry Day Premium Killer What It Is: A strategy where an investor sells both a Call and a Put at the same strike price. How It Works: You make money from the decay of the premium, which accelerates as time passes, especially on the day of expiry if the market hardly moves. Ideal For: Expiry day, especially when low volatility is expected. ⚠️ Risk Alert: If the market moves violently, losses can be huge. Use strict stop-loss orders while about this strategy. Why Beginners Should Be Cautious: Do not attempt unless you are confident of your price action knowledge and stop-loss management. 5. Long Strangle – Big Move? Big Profit What It Is: A direction-neutral strategy that benefits from huge market movement in any direction. How It Works: When the market moves sharply higher or lower, profits on one leg of the trade will be substantial and far outweigh the losses on the other leg. Ideal For: Cases when you expect high volatility such as: Why Beginners Should Try This and Not Another: You can participate in market events with limited risk and clear payoff structure. 6. Intraday Scalping with Options – Fast Profits in Minutes What It Is: This is a very short-term trading technique that enters and exits trades in a matter of minutes on the basis of price momentum. How It Works: Best For: Days when the market moves fast or sessions triggered by news announcements. 🎯 Join The Safe Trader Academy’s Live Sessions to scalp with experts. Why Beginners Should Learn First: Scalping needs quick decisions and strong discipline—start only under mentorship to avoid emotional mistakes. 7. Covered Call- Passive Income for Stockholders What It Is: A way to earn some income from stocks you already have by selling call options against them. How It Works: If the stock price does not cross the strike price, you keep both your stock and the premium. Best For: Positional or long-term traders who wish to enhance their returns. Why Beginners Should Love This: It’s a really safe way to learn options while still being an investor in stocks. When to Use These Strategies? Strategy Best Market Condition Risk Level Iron Condor Sideways / Range-bound Low Bull Call Spread Mild Uptrend Medium Bear Put Spread Mild Downtrend Medium Short Straddle Expiry Day / Flat Market High Long Strangle High Volatility / Event Days Medium Intraday Scalping Trending / Fast Markets High Covered Call Long-term Stock Holdings Low Why Learn Options Trading with The Safe Trader Academy? We don’t just teach theory—we take you inside the live market, explain strategies in real-time, and help you gain confidence and consistency. Why hundreds of traders trust us: 🎯 Final Thoughts Consistency in options trading is not about luck — it’s about strategy, discipline, and practice. The top traders don’t trade everything; they master a few key setups and execute them with precision. Ready to build weekly income through options trading? 👉 Join The Safe Trader Academy today and start trading like a pro.